Rosh Pinah Zinc (RPZ) and Appian Capital Advisory Limited have announced that RPZ has secured a US$150 million debt facility underwritten by Standard Bank to finance the development of its expansion project, RP2.0.

The financing is a key milestone for the expansion, which will modernise its infrastructure and nearly double RPZ’s production output.

Construction is over 80% complete. The financing will fund the remaining construction costs of RPZ’s expansion, with the project now funded through to ramp-up.

Appian, the majority shareholder of RPZ, undertook a competitive tender process with multiple parties and is pleased to partner with Standard Bank in this transaction.

In a statement, RPZ said that Standard Bank’s backing of the expansion builds on its established relationship with RPZ and follows extensive technical, legal, environmental, and social due diligence. It offers a strong endorsement of the commercial viability and ESG standards of RP2.0.

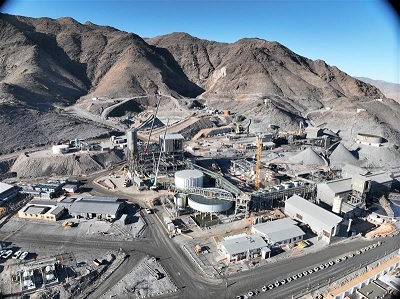

The RP2.0 expansion project comprises further development of the underground mine, as well as the construction of new surface facilities, including a new processing plant, the addition of a paste fill and water treatment plant, and a newly developed portal and decline to extended underground deposits.

RP2.0 will almost double the mine’s production output to 170 million lb/year of contained zinc metal.

Construction of RP2.0 surface facilities is now over 80% complete and remains on budget. Construction completion is expected in the third quarter of 2026, with ramp-up commencing in quick succession.

Alex Mayrick, the General Manager at Rosh Pinah Zinc, commented: “RPZ is pleased to have concluded this important deal, which will provide us with financial flexibility as we continue to progress the construction of RP2.0.

“Standard Bank is a longstanding supporter of RPZ and a leading financial partner for the metals and mining industry in Africa. We are encouraged by their confidence in the project and our long-term vision.”

Ignacio Bustamante, the Head of Base Metals at Appian, commented: “Securing this financing is a major step forward for RPZ and RP2.0. The expansion is a key component of our strategy to optimize operations and extend mining life at RPZ.

“With this funding, we can continue to focus on developing an asset that will deliver value for all stakeholders for many years to come.”

Endeavour Financial acted as Appian’s financial advisor for the transaction.

In the photo: The Rosh Pinah Zinc mine’s expansion project, known as RP2.0.