Letshego Holdings Namibia, a parent company of Letshego Bank and Letshego Micro Financial Services, has announced its unaudited condensed consolidated interim results for the six months ended 30 June 2024.

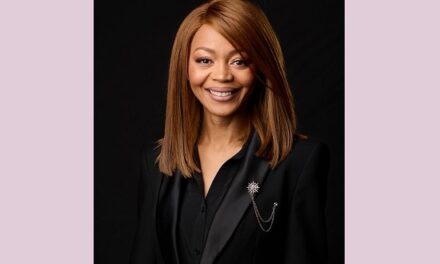

In a statement, Letshego Holding Namibia’s CEO Dr. Ester Kali said that the Group continues to make significant strides in implementing its ‘6-2-5’ Transformation Strategy, with positive financial performance driven by innovation, customer-centricity, and an expanded product portfolio.

For the first half of 2024, Letshego recorded robust growth of 14% year-on-year increase in total revenue, primarily driven by a 21% rise in interest income.

Net interest income grew by 15% to N$251 million (2023: N$218 million), strengthened by a 3% increase in net advances to customers and strategic repricing of low-interest loans. The Group maintained a healthy net interest margin, which improved from 7% to 8%.

Profit after tax rose by 16% to N$199 million (2023: N$171 million), reflecting the Group’s strategic focus on efficiency and product diversification.

The cost-to-income ratio remained stable at 45%, while the return on average equity increased to 15% (2023: 12%).

Earnings and headline earnings per share improved to 40 cents (2023: 34 cents). The Group remains well-capitalised, with a capital adequacy ratio of 35% (2023: 32%).

The Group has made significant progress in diversifying its funding base, reducing reliance on intercompany and equity funding by expanding its local funding to N$2.8 billion.

Additionally, Letshego’s inaugural social listing on the Namibian Stock Exchange (NSX) was met with strong market interest, receiving bids totalling N$322 million and resulting in the issuance of N$260 million in three-year senior unsecured notes. Customer deposits also saw significant growth, reaching N$1.05 billion at the end of June 2024, compared to N$662 million in June 2023.

Dr. Kali emphasised the Group’s commitment to maintaining a robust risk management framework, stating, “Letshego Namibia continues to adopt an integrated risk management approach that aligns with both international best practices and local requirements.

“Recent governance updates include the appointment of Mansueta-Maria Nakale as Chairperson, Independent Non-Executive Directors to the Board, including Jerome Mutumba, Jaco Esterhuyse and Non-Executive Director, Richard Ochieng, strengthening oversight and strategic guidance.”

The Group declared a dividend of 39.89 cents per ordinary share for the period, following a dividend payment of N$181.9 million (36.38 cents per share) during the June 2024 period.

Letshego is well-positioned to capitalise on opportunities in the current economic environment.

The focus remains on leveraging technology, nurturing partnerships, and embracing agility to navigate the evolving financial landscape and create long-term value for stakeholders.

In the photo: Letshego Holding Namibia’s CEO Dr. Ester Kali.