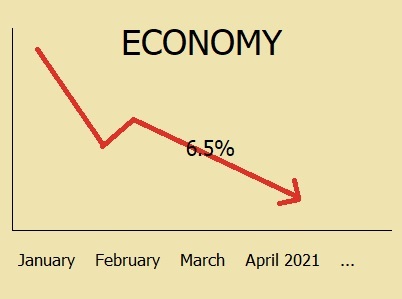

The Namibian economy shrunk further by 6.5% during the first quarter of 2021 compared to a contraction of 2.5% in the first quarter of last year.

This dismal information was revealed by the Agricultural Bank’s research and product development department in their monthly market watch report yesterday.

The contraction of the economy is attributed to the Covid-19 pandemic.

“The poor performance can be attributed to diminished demand by both international and domestic consumers. The recent lockdowns, travel and gathering restrictions due to rising Covid-19 cases cast renewed fears for downward revision of initial growth projections.

“The soft outlook is exacerbated by the sluggish 1Q2021 (first quarter of 2021) GDP numbers. The economy was initially projected to grow at 2.2% and 2.5% in 2021 and 2022 owing to a recovery in global demand, increase commodity prices and a stable health environment due to vaccination.

“We revised our GDP outlook down to 1.5% in 2021 with a based effect rebound of 2.8% in 2022. The downside projection is strengthened by sluggish leading indicators coupled with 2Q2021 lockdown triggered slowdowns in certain sectors.

“The increase in the number of Covid-19 deaths (even in the business world) triggered investment uncertainty for new business ventures. Consumer and business environment will remain gloomy for the remainder of the year,” said the report.

Pointing to inflation as the ‘Inevitable ticking time bomb’ the report said that lack of actual improvement in productivity and reinvestment in real economic drivers amidst prevailing low interest rate environment could fuel an economic collapse when spiralling inflation leads to rising interest rates soon.

Inflation doubled to 4.1% in June 2021 when compared to an increase of 2.1% recorded in 2020. Food and non-alcoholic beverages category is on an upward spiral, increasing to 7.3% in June 2021 compared to 4.7% in 2020.

“The increase can be attributed to a rise in meat and oils & fats prices to 16.0% and 16.7% in June 2021; a similar trend was observed in the beef and sheep producer prices. The rise in global oil prices continues to affect local petrol prices, with a rising in transport cost to 9.6% in June 2021 compared to -0.8% in the prior year.

“Ignoring inflation to prioritise on social economic goals leaves the economy sitting on a timing bomb that could have an equally devastating effect,” the report stated.

Meanwhile the agriculture and forestry sector is expected to remain positive in 2021, albeit at a slower pace compared to a 13.9% growth in 2020.

The sector is projected to grow by 4.5% and 5.0% in 2021 and 2022, respectively, mainly driven by crop and forestry production.

However the total number of cattle marketed this year until June declined by 25% to 94 868, while sheep declined by 5% to 220 045. While goats marketed increased by 63% to 49 690 during the same period.

“Due to sluggish livestock numbers coupled with rebuilding of herd, we are of the view that livestock will slack behind, contracting by 1.2% in 2021 before improving in 2022. Forestry production and crop farming remains the beacon of hope for the agricultural sector in 2021.”

In conclusion the report indicated that rising inflation continues to raise eyebrows for policy makers to balance between social economic goals and keeping inflation in check to avoid repeated economic collapse in the near future.