Namibia Financial Institutions Supervisory Authority (NAMFISA) was in Oshakati today to present the draft Consumer Credit Bill to the people for their input.

NAMFISA is on the road engaging in public consultations to sensitise members of the pubic and affected institutions and ask for their input before the draft is sent to the Minister of Finance and Public Enterprises for tabling in Parliament.

The purpose of the Bill is to promote fair, transparent and responsible market conduct in the consumer credit market where consumers of credit are protected by ensuring that there is proper regulation in the manner in which credit providers conduct their businesses as well as ensure fair treatment of consumers.

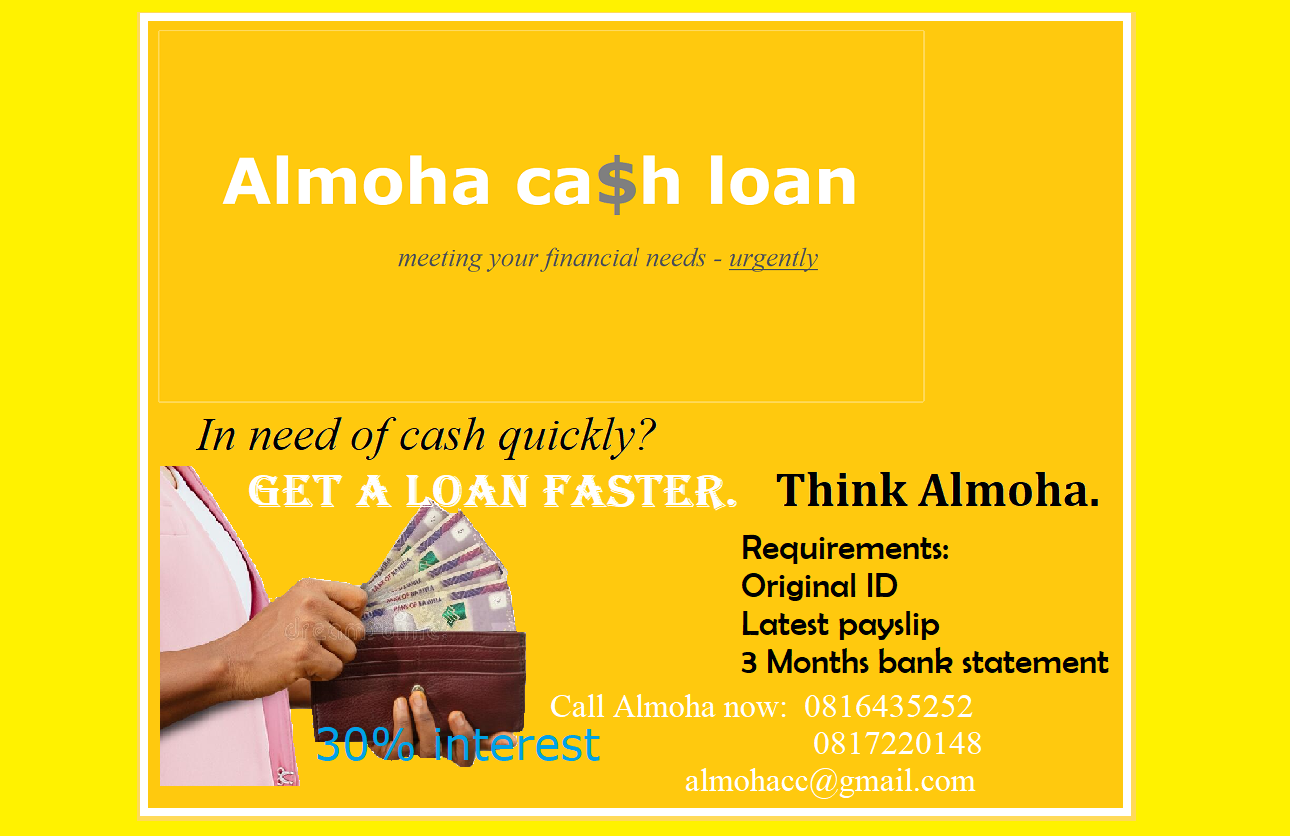

“So far there is no regulation in how credit providers, credit bureaus and debt collectors conduct their businesses, therefore this bill is aimed at providing a regulatory framework in the consumer credit market,” said Ms Victoria Muranda, NAMFISA’s communications and public relations officer.

Officials of NAMFISA, GIZ, and Bank of Namibia delivered presentations at the Oshakati consultation which covered the scope of the bill, meanings of terms such as consumer, credit provider, credit bureaus and debt collector, as well as functions of consumer credit regulators, and others.

The bill also provides for penalties for non-compliance with the law.

The bill states that “A credit provider who intentionally enters into an unlawful agreement with a consumer; includes an unlawful provision contemplated in section 71 in a credit agreement; intentionally sells a debt under a credit agreement to which the Bill applies, and which debt has been extinguished by prescription under the Prescription Act, 1969, is guilty of an offence.

“If convicted, the court must exercise its discretion and may impose fines not exceeding N$5 000 000, or imprisonment not exceeding ten years, or both.”

After Kunene Region (Opuwo), Omusati Region (Outapi) and Oshana Region (Oshakati) the NAMFISA team will be proceeding to Ohangwena Region (Eenhana) and then Oshikoto Region before going further down to the rest of the country.

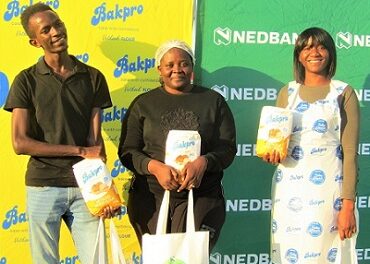

In the photo: The public consultations on the Consumer Credit Bill that took place at Oshakati.